Fund II

Global Health Impact Fund II, LP

Global Health Impact Fund II LP (GHIF) The investment objective of GHIF II is to provide investors above-average risk-adjusted returns through equity and convertible debt investments in early-stage healthcare companies.

GHIF II’s investment process is devoted to networking and facilitating investments in partnership with its targeted multi-specialty community network, in partnership with Global Health Impact Network, Inc (“GHIN” or the “Network”). GHIF II’s goal is to leverage the connectivity between and among the investors and invested portfolio companies in the early-stage healthcare investment space

Challenges for Healthcare Investors

- Deal flow is elusive

- Conventional approaches no longer work

- Clinical/scientific expertise is hard to find and engage

- Must build and leverage a network of experts*

- Investments require proactive, data-driven decision making

- Must track key success factors over time

* Pathologists predicted the Theranos debacle, but their voices were missing from most news coverage – https://www.healthnewsreview.org/2018/06/

GHIF Strategic Network

Adding Unique Value: Deal Sourcing Through Liquidity

Pre-Investment

GHIF leverages our Strategic Network of clinician LPs, healthcare executives, technologists, advisors, HCOs and existing investment CEOs tåço generate qualified deal flow. The GHIF Strategic Networks assists in vetting the clinical model, business model, and the technological underpinnings of each company.

Post-Investment

Post-investment, the GHIF Strategic Network collectively supports business development activity for å companies and acts as a source for strategic introductions across hiring, closing sales or implementations, and future fundraising.

A Diverse Clinical And Corporate Network

Mukesh Advani

General Counsel

Sheetal Nariani

Chief Financial Officer

Richard Hirschinger

Orofacial Pain & Dental Sleep Medicine

Michael Pocalyko

Cybersecurity

Steve Lazer

Healthcare IT infrastructure

Janet Goldman

Obstetrics & Gynecology

Robert G Darling

Emergency Medicine, Infrastructure Development in Conflict & Disaster Regions

Ray Wurapa

Orthopedic Hand surgery

Kirk Heath

General Surgery, Healthcare IT, EMR

John Kwan

Periodontist

Brian Howard

Plastic Surgery, Otolaryngology/Head and Neck Surgery

Walter “Buzz” Stewart

Entrepreneur, Chief Research Officer, Healthcare Analyst, Epidemiologist

James H. Philip

Anesthesiology, Biomedical Engineering

Bruce Auerbach

Emergency Medicine

Jason Fung

Dermatology

Gita Channan

Family Medicine, Biochemistry

Erkan Hassan

Clinical Pharmacy, Pharmacology

George Baloyra

Chiropractor

Abhita Batra

Biopharmaceuticals, Oncology

Drew Albert

Orthopedic Surgery, innovative health technology

Nicholas Henderson

Investment and Fund Raising

James Ernest (Ernie) Riddle

Healthcare Executive and Transformational Strategy

Jeffrey Gubbels

Healthcare Management and Operational Executive

Nicholas Hyde

Vein Specialists, Vascular Health

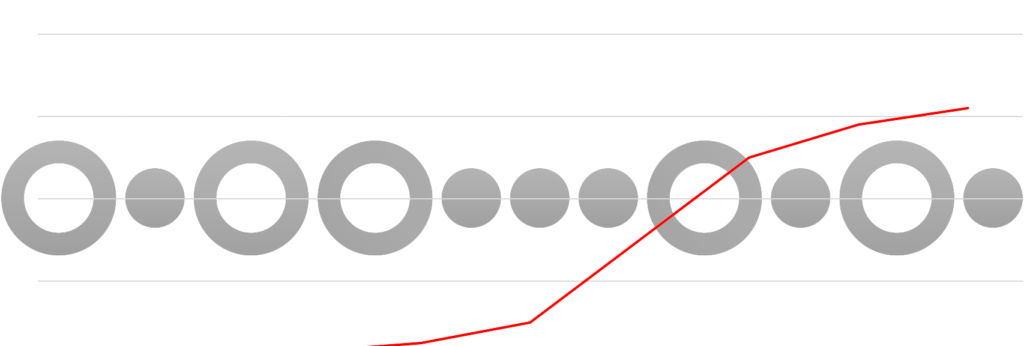

Healthcare Company Lifecycle : Understanding Valuation Inflection Points

GHIF Tracks Success Factors

Life science companies have specific success factors that we’ve identified and built into a set of rubrics for digital health, medical device and bioscience companies. Some examples are in the chart below. We’ve used these metrics to identify companies that outperform their peers as they grow

Subjective

- Product

- Marketability

- Reimbursement

- Technology

- Competition

- Clinical Validation

Objective

- Management Team

- Advisory Board

- IP Development & Protection

- Clinical Trials

- Revenue

- Regulatory pathway

GHIF’s Unique and Powerful Model

- GHIF proprietary, analytical approach to due diligence with clinician weighted focus

- GHIF/N has a strategic network of clinical experts, proven health care industry executives, and entrepreneurs actively involved in portfolio selection.

- GHIF/N strategic network is uniquely positioned to provide post-investment support through liquidity events